The Government is introducing a fundamental change for UK resident non-domiciled individual (non-doms) from 6 April 2017. The new deemed UK domicile rules will mean that some non-doms will no longer be able to use the remittance basis and instead will be subject to UK tax on their worldwide income and gains. Additionally, all UK residential property will be subject to IHT. Non-doms are therefore strongly advised to take time now to review their assets and structures so that they will be able to act quickly once further details are announced.

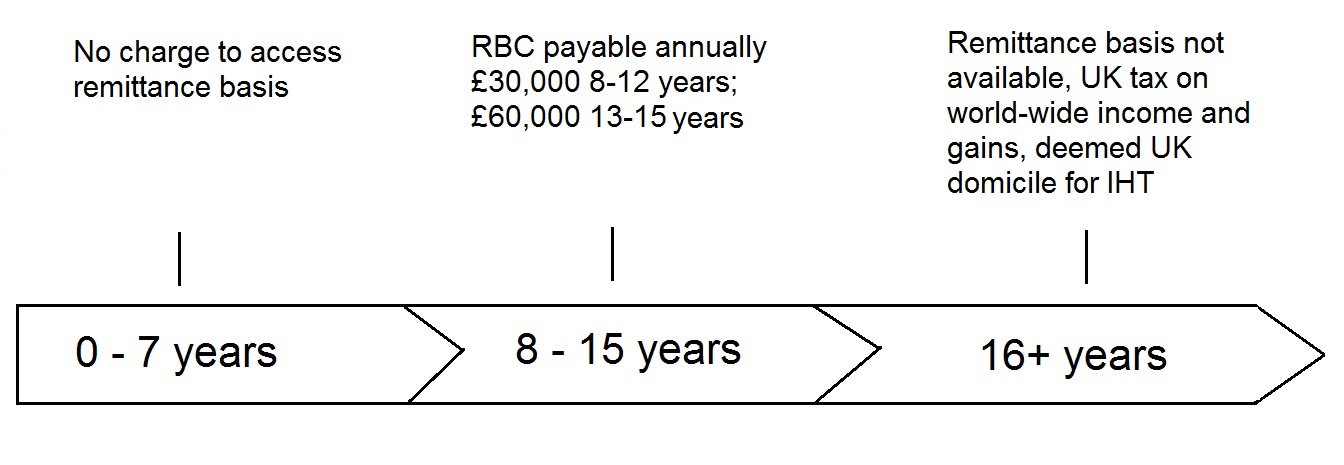

The table below shows how the length of an individual’s period of UK residence will affect the UK tax treatment of their non-UK income and capital gains and also UK IHT status.

When will the new rules take effect?

Deemed UK domicile will apply:

- where at any time on or after 6 April 2017 an individual has been resident in the UK for 15 out of the previous 20 tax years; and

- for individuals born with a UK domicile of origin who return to take up residence in the UK, even if for only a temporary period.

It is therefore imperative to review an individual’s circumstances to identify when they may become deemed UK domicile.

Impact of new rules

Under the new rules the remittance basis will no longer be available for non-UK income and gains that arise after an individual becomes deemed UK domiciled (‘new income and gains’). The remittance basis will however still apply to income and gains arising before that time (‘old income and gains’). There will be a rebasing of assets to 6 April 2017 values for capital gains purposes.

In light of these new rules affected individuals should be giving consideration to the following issues:

Separation of ‘old’ and ‘new’ income and gains

Individuals should be considering now how they can separate ‘new income and gains’ from ‘old income and gains; the latter will remain taxable on the remittance basis.

Realisation of income and gains

Individuals whilst taking investment considerations into account, should consider realising income and gains prior to becoming deemed UK domiciled, so that these count as ‘old income and gains’ taxable on the remittance basis. These aspects should be considered in the light of the rebasing of assets to 6 April 2017.

Offshore trusts

The Government has indicated that it will provide a new regime for offshore trusts established by individuals before they become deemed UK domiciled under the new rules.

This regime is intended to provide for the continuation of the remittance basis for non-UK income and gains arising to the trust after the settlor has become deemed UK domiciled.

Non-doms should therefore consider whether existing trusts will be of use once they become deemed UK domiciled and if revised investment decisions need to be considered.

For non-doms without an existing trust, should a trust be established before they become deemed UK domiciled?

Inheritance tax

The new deemed UK domicile rule will also apply for inheritance tax (IHT). Additional rules bring UK properties owned through non-UK structures into the charge of IHT from 6 April 2017. In light of these proposed changes, non-doms should be reviewing the plans that they have made for UK residential property. A life time IHT charge can arise in certain circumstances and it is important to identify if existing plans for estates on death are still appropriate.

This is a complex area and if you feel you are affected please give Sue Stephens a call as soon as possible as such planning cannot be rushed and requires sufficient time to ensure the appropriate action is put in place.